Broker

-

Master Capital Gains on House Flip Taxes

How to Master Capital Gains on House Flip Taxes Capital gains house flip taxes present a significant compliance and operational challenge for real estate brokerages and their agents, especially those working with active investors. The intricacies of classifying income, tracking holding periods, and documenting expenses add layers of complexity to transactions that often operate on

-

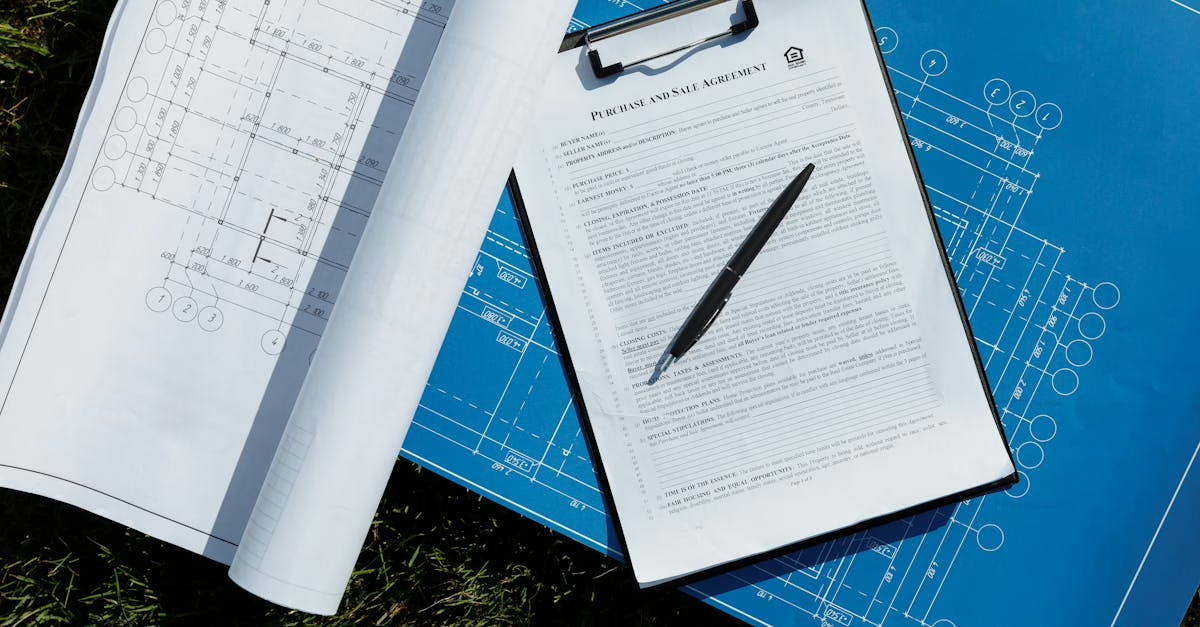

Mastering the Exclusive Real Estate Agent Contract: A Broker’s Guide

Mastering the Exclusive Real Estate Agent Contract The exclusive real estate agent contract is a cornerstone of brokerage operations, yet managing these agreements presents significant compliance and operational pain points for many real estate brokers. Ensuring each contract is correctly drafted, fully executed, and meticulously tracked is paramount not only for legal compliance but also

-

Navigating Flipping Houses Capital Gains Tax Rules

\ Navigating Flipping Houses Capital Gains Tax Rules: A Realtor\’s Guide Flipping houses capital gains tax rules present a significant operational and compliance challenge for real estate brokers and their teams. Navigating the nuances between short-term ordinary income tax rates and potentially lower long-term capital gains rates requires meticulous record-keeping, precise timeline tracking, and robust

-

Mastering the HO5 Homeowners Policy: Your Broker’s Guide

Mastering the HO5 Homeowners Policy: Your Broker’s Essential Guide Ho5 homeowners policy understanding is more than just a checkbox for real estate brokers; it’s a critical component of compliance, risk management, and providing exceptional client service. As a former Realtor myself, I know the complexities that arise during a transaction, and navigating insurance requirements can

-

Mastering the Broker Exclusive: Strategy and Compliance

Mastering Broker Exclusive Listing Strategies for Brokers Broker exclusive listing presents a unique opportunity for real estate brokers to serve clients outside the traditional Multiple Listing Service (MLS) framework, offering discretion and tailored marketing. However, navigating the strategic use and, critically, the compliance pitfalls of broker exclusive listings can be a significant operational pain point.

-

Average FEMA Payout Data: A Broker’s Guide to Understanding Aid

Streamlining Brokerage Operations with AI Transaction Coordinators: A Realtor’s View AI transaction coordinators are rapidly changing the landscape of real estate back-office operations. As a former US Realtor, I vividly recall the constant tightrope walk between closing deals and ensuring every single piece of paperwork was not just filed, but compliant. The operational and compliance

-

Understanding the Buyer Rebate: A Broker’s Guide to Compliance

Understanding the Buyer Rebate: A Broker’s Compliance Guide Buyer rebate: For many brokers, this term conjures images of competitive edges and satisfied clients, but also the lurking shadow of complex compliance issues. As a former US Realtor, I’ve seen firsthand how navigating the patchwork of state regulations around buyer rebates can create significant operational pain

-

Understanding Buyer Remorse Law: A Broker’s Guide

Understanding Buyer Remorse Law: A Broker’s Practical Guide Buyer remorse law presents a perennial challenge for real estate brokers, often manifesting as a compliance headache and a potential operational bottleneck. As a former Realtor, I’ve seen firsthand how a buyer’s change of heart can throw a transaction into chaos, consuming valuable administrative time and sometimes

-

How Brokers Calculate Absorption Rate Accurately and Formally

Mastering Market Insights: How Brokers Calculate Absorption Rate Accurately To calculate absorption rate is a fundamental task for real estate brokers, yet ensuring accuracy and formal reporting often presents a significant operational pain point. Misinterpreting market speed can lead to flawed strategies, inaccurate agent guidance, and even compliance issues. Understanding precisely how to calculate absorption